Download news release PDF

Download Verizon's Investor Day 2021 Infographic

NEW YORK, NY –

Verizon will soon be able to offer increased mobility and broadband services to millions more consumers and businesses as a result of the recent FCC C-Band auction. In an investor event tonight, the company’s executive team discussed the acceleration of its strategy and plans to use the strong spectrum position in the industry to continue to drive growth.

C-Band auction results

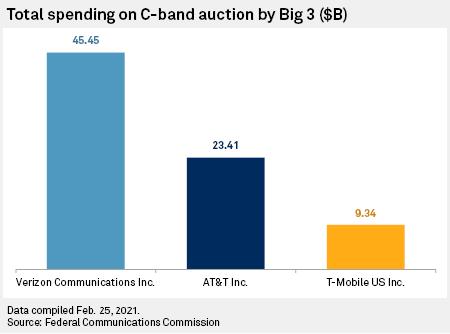

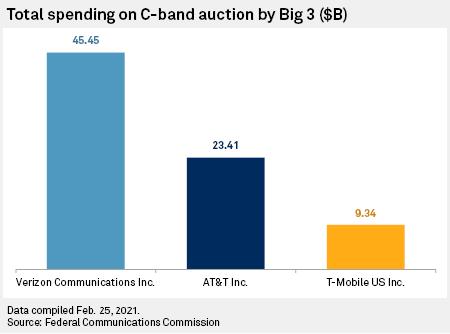

Verizon succeeded in more than doubling its existing mid-band spectrum holdings by adding an average of 161 MHz of C-Band nationwide for $52.9 billion including incentive payments and clearing costs.

Verizon won between 140 and 200 megahertz of C-Band spectrum in every available market. Specifically, Verizon:

Secured a minimum 140 megahertz of total spectrum in the contiguous United States and an average of 161 megahertz nationwide; that’s bandwidth in every available market, 406 markets in all.

Secured a consistent 60 megahertz of early clearing spectrum in the initial 46 markets - this is the swath of spectrum targeted for clearing by the end of 2021, home to more than half of the U.S. population.

Secured up to 200 megahertz in 158 mostly rural markets covering nearly 40 million people. This will further enhance Verizon’s broadband solution portfolio for rural America.

The auction results represent a 120 percent increase in Verizon’s spectrum holdings in sub-6 gigahertz bands. The quality of this spectrum and Verizon’s depth of licensed holdings represent the premier asset in the industry. In addition, C-Band is a widely used spectrum band throughout the world and will allow for roaming opportunities and economies of scale. The spectrum bands Verizon won are contiguous, which will streamline deployment of this spectrum across the mainland United States.

Accelerate Verizon’s 5G mobility network

In the next 12 months, Verizon expects to have incremental 5G bandwidth via the new spectrum available to 100 million people in the initial 46 markets, delivering 5G Ultra Wideband performance on C-Band spectrum. Over 2022 and 2023, coverage is expected to increase to more than 175 million people and by 2024 and beyond, when the remaining C-Band is cleared, more than 250 million people are expected to have access to Verizon’s 5G Ultra Wideband service on C-Band spectrum.

More than 70% of the 5G devices in the hands of customers today are C-Band compatible. Every iPhone 12 model is C-Band compatible. The Samsung Galaxy S21 series and Google Pixel 5 are also compatible. Going forward, all new 5G handsets Verizon brings to market to postpaid customers will be C-Band compatible, with more than 20 C-Band compatible devices offered by the end of the year.

Accelerate 5G fixed wireless access broadband adoption

The acquisition of this C-Band spectrum will be a critical component in Verizon’s 5G broadband strategy -- 5G Home and 5G Business Internet.

5G Home:

By the end of this year, Verizon expects to cover nearly 15 million homes with its home broadband product, and by the end of 2023, 30 million homes, using both 4G and 5G. To accompany the growth in fixed broadband offerings, the company introduced new 5G Home devices which will be simple for customers to install in their homes - including the Internet Gateway, and the Verizon Smart Display, which join the

Verizon 5G Internet Gateway

. All three devices will have a sleek design and ‘self setup’ featuring AR guidance, simple instruction videos, and in-app chat and call support.

5G Home internet, the super fast service with download speeds up to 1 Gbps, depending on location, is currently available in 18 markets, with one to two million households expected to be covered via mmWave by end of 2021 and a total of 15 million with LTE Home and the arrival of the first tranche of C-Band. Verizon has teamed up with some of the best content providers in the industry to bring customers plenty of options for all their gaming and streaming needs.

5G Business Internet:

5G Business Internet complements the full suite of Verizon Business tools and offerings, including OneTalk voice communications, BlueJeans by Verizon video-collaboration platform, advanced security and other business services.

By using a high powered fixed 5G receiver, business customers will be able to access the broadband speeds they need with the reliability from Verizon they have come to expect. 5G Business Internet is now available in three markets on mmWave with plans to bring the product to 20 more before the end of the year.

Accelerate 5G Edge

Verizon Business is well positioned to capture significant edge compute share and is in-market today with both public and private MEC models in collaboration with leading cloud providers. With the addition of C-Band spectrum, the company expects a wider and faster path to monetization.

By the end of 2022, the total edge compute addressable market in the U.S. is estimated to reach $1 billion, and by 2025, rapid adoption of Edge Compute is estimated to create a $10 billion addressable marketplace.

Public MEC Model:

Last year, the company partnered with AWS: Wavelength and immediately connected AWS’s 1 million plus developer community to the nearly 170 million end-devices across Verizon’s 4G and 5G Nationwide networks at the edge. Developers today are building use cases spanning a wide array of commercial applications - all through an easy on-ramp in the AWS portal where they can move their workloads to the edge of our network, automatically triggering a recurring revenue share for Verizon and AWS. This partnership enables Verizon Business to be a key participant in this growing opportunity with C-Band accelerating our reach and time to market.

Private MEC Model:

Last year, Verizon Business announced a collaboration with Microsoft to deliver a Private MEC model for customers that want a completely dedicated edge compute infrastructure on-premise to provide unique connectivity for their employees, enable data-intensive applications and benefit from solutions like computer vision, augmented reality and machine learning - all built to increase productivity, provide enhanced security and reduce latency in ways that wi-fi cannot.

This fully integrated Verizon solution includes:

Verizon Private Edge, which combines the power of Microsoft Azure cloud and edge capabilities with 5G on the customer premise.

Verizon Private network connectivity, which is forecast to be a $10 billion dollar global market by 2025.

Co-developed real-time enterprise solutions like Intelligent Logistics, Predictive Maintenance, Robotics and Factory Automation, which give Verizon Business a direct line of sight to another $12 billion applications and solutions addressable opportunity by 2025 that will be commercialized through a growing partner ecosystem, including IBM, Cisco, Deloitte and SAP.

The demand for MEC services unlocks an estimated Verizon total market that is forecast to exceed $30 billion by 2025, revenue that will be shared with partners.

Strong growth in the years ahead and incremental capital deployment

The acquisition of C-Band spectrum accelerates Verizon’s five vectors of growth and is expected to deliver strong growth in the years ahead. Specifically,

Growth of 2% or more in Service and Other revenue for 2021, as disclosed at our Q4 2020 earnings on January 26, 2021 in the build period of C-Band deployment

Growth of 3% or more in Service and Other revenue in 2022 and 2023 in the scale period

Growth of 4% or more in Service and Other revenue in 2024 in the nationwide period

In addition, Verizon is committing to an additional $10 billion in capital expenditures over the next three years to deploy C-Band as quickly as possible. This spend will be in addition to the current capital expenditure guidance of $17.5B-$18.5B for 2021, which is expected to be at comparable levels through 2023.

See how 5G can transform your business.

Executive Quotes

Hans Vestberg, Chairman and CEO of Verizon

FCC C-Band auction results

“Today is one of the most significant days in our 20-year history. This was a highly successful auction for Verizon – a once in a lifetime opportunity – and I am thrilled with what we were able to accomplish.”

Verizon’s strategy

“Our growth model is based on a clear vision: We are a multi-purpose network company with the best networks architected by the best engineers on the planet. This idea of a multi-purpose network at scale is our strategic foundation to maximize growth and put us in a position to realize the best return on investment in the fully-networked economy.”

Verizon’s competitive advantage

“Since we began building 5G, we have had a first mover advantage. We are more than a year ahead in building and selling mmWave with our 5G Ultra Wideband service and still the only company with commercial Mobile Edge Compute. Now we intend to extend our lead by accelerating our deployment of C-Band. Our new C-Band position combined with our mmWave, means we are the only carrier suited to deploy the fastest, most powerful 5G experience to the most people - or as we call it, 5G built right.”

Ronan Dunne, CEO of Verizon Consumer Group

5G adoption

“Customers are migrating to 5G in earnest. As of YE 2020, 9% of our Consumer postpaid phone base were on a 5G device. With the exciting device lineup we have in store, and the superior 5G experience that we deliver, we expect to reach 50% some 18 months ahead of GSMA forecast, and end 2023 ahead of even the more ambitious Ericsson Mobility Report forecast.”

5G devices

“Overall we have 10M 5G Ultra Wideband devices in the hands of customers on our network today. And of those, approximately 70% are already C-Band compatible. Going forward all new 5G handsets we sell to postpaid customers will be C-Band compatible.”

Step ups

“We have seen tremendous step-ups from our customers from Metered to Unlimited and Unlimited to Premium Unlimited as we discussed back in November. We continue to see this with over 20% of our postpaid accounts ending the year on a Premium Unlimited plan. We expect this number to grow to over 30% this year and approximately 50% by 2023. With C-Band included, we think step-ups to premium will only accelerate.”

5G Home acceleration

“By the end of 2021 we will have between 1 and 2 million millimeter wave 5G Homes open for sale and some 15 million in total with the arrival of the first tranche of C Band. By the end of 2023 this will have risen to more than 30 million households we can serve.”

Tami Erwin, CEO of Verizon Business

Mobile Edge Compute

“Verizon Business has a strong first-mover advantage to build a nationwide Mobile Edge Compute platform and be both a market leader and a market maker. This is not just an idea, it’s happening. Companies in every industry are finding exciting ways to bring 5G and 5G Edge to life - leveraging the full capabilities of 5G from throughput and ultra-low latency to sensor densification and rock solid reliability.”

Kyle Malady, CTO of Verizon

Auction results

“We secured a game-changing amount of C-Band spectrum to go along with our leadership in millimeter wave spectrum. We’ve been planning for many months, and are already working to make this the fastest deployment of new spectrum ever. As the leader in the wireless industry, we have consistently deployed a deep portfolio of strong spectrum holdings with best in class technology capabilities. This same focus will continue to position us for growth for years to come.”

Matt Ellis, CFO of Verizon

“Our Network as a Service strategy is our foundation when considering significant investments. We’ve leveraged that framework, investing in key strategic areas, such as spectrum, network assets, partnerships, and disciplined M&A, to position us for this next technology era.”

“Our strategy is working. Our core business is producing revenue growth today. More customers are experiencing the benefits of 5G Ultra Wideband every month on our millimeter wave spectrum and C-Band helps us accelerate the timeline and expand upon that growth.”

“Safe Harbor” Statement

NOTE: In this presentation we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “believes,” “estimates,” “expects,” “hopes,” “forecasts,” “plans'' or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. The following important factors, along with those discussed in our filings with the Securities and Exchange Commission (the “SEC”), could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements: cyber attacks impacting our networks or systems and any resulting financial or reputational impact; natural disasters, terrorist attacks or acts of war or significant litigation and any resulting financial or reputational impact; the impact of the COVID-19 pandemic on our operations, our employees and the ways in which our customers use our networks and other products and services; disruption of our key suppliers’ or vendors’ provisioning of products or services, including as a result of the COVID-19 pandemic; material adverse changes in labor matters and any resulting financial or operational impact; the effects of competition in the markets in which we operate; failure to take advantage of developments in technology and address changes in consumer demand; performance issues or delays in the deployment of our 5G network resulting in significant costs or a reduction in the anticipated benefits of the enhancement to our networks; the inability to implement our business strategy; adverse conditions in the U.S. and international economies; changes in the regulatory environment in which we operate, including any increase in restrictions on our ability to operate our networks or businesses; our high level of indebtedness; an adverse change in the ratings afforded our debt securities by nationally accredited ratings organizations or adverse conditions in the credit markets affecting the cost, including interest rates, and/or availability of further financing; significant increases in benefit plan costs or lower investment returns on plan assets; changes in tax laws or treaties, or in their interpretation; and changes in accounting assumptions that regulatory agencies, including the SEC, may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings.